Professional services and investment management company, Colliers announced it has entered into a definitive agreement to acquire Englobe Corporation, a leading Canadian multi-discipline engineering, environmental and inspection services firm.

Englobe’s senior leadership team and employee shareholders will remain shareholders in the business under Colliers’ unique partnership model.

“The acquisition of Englobe marks a significant entry for Colliers into the Canadian engineering marketplace and aligns perfectly with our strategy of enhancing our growing professional services and investment management company with high-value, resilient, and essential services,” said Jay Hennick, global chairman and CEO of Colliers. “Once the transaction is completed, recurring earnings from Engineering, Investment Management and Outsourcing will collectively represent about 75 per cent of our total earnings. With Investment Management, Engineering and Commercial Real Estate Services, Colliers has three significant and complementary global growth engines to continue to generate value for shareholders for many years to come.”

Headquartered in Laval, Québec, Englobe’s 2,800 professionals provide civil, buildings, geotechnical, and environmental engineering, material testing and related consulting services to public and private sector clients primarily in the transportation, water, buildings, and power end markets. In 2023, the business generated US$340 million of revenues. The business will be rebranded as Colliers in 2025.

“Colliers’ enterprising culture, decentralized operating style, focus on service excellence and employee engagement align well with Englobe’s key values, making Colliers the perfect partner for the next chapter of our journey,” said Mike Cormier, Englobe president. “Joining a best-in-class professional services organization with a global brand and international platform will allow us to accelerate our growth going forward, as well as offer better services to our clients and more opportunities to our professionals. Our team is more than excited to join the Colliers family.”

Under the terms of the transaction, Colliers will acquire a significant controlling interest for approximately US$475 million in cash payable at closing. Englobe’s material management and beneficial reuse operations located in the UK, France and Canada are not included in the transaction. The transaction is subject to customary closing conditions and is expected to close in the third quarter of 2024.

“Building on our success in the U.S. and Australia, we look forward to entering the attractive Canadian engineering services market, a business that complements our current leadership in project management in Canada,” said Elias Mulamoottil, co-chief investment officer of Colliers. “Englobe’s national footprint, deep public sector relationships, and infrastructure expertise put Colliers Canada in an enviable position to capitalize on industry tailwinds that drive this stable and predictable business.”

In connection with this transaction, Torys LLP acted as legal advisor to Colliers. AEC Advisors acted as financial advisor and Stikeman Elliott acted as legal advisors to Englobe.

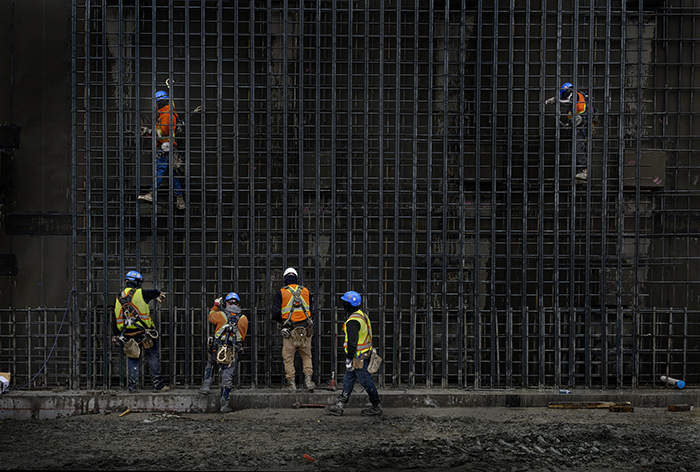

Featured image: (Englobe)